We Helped Many Businesses Get online

Your website should be a marketing asset, not an engineering challenge.

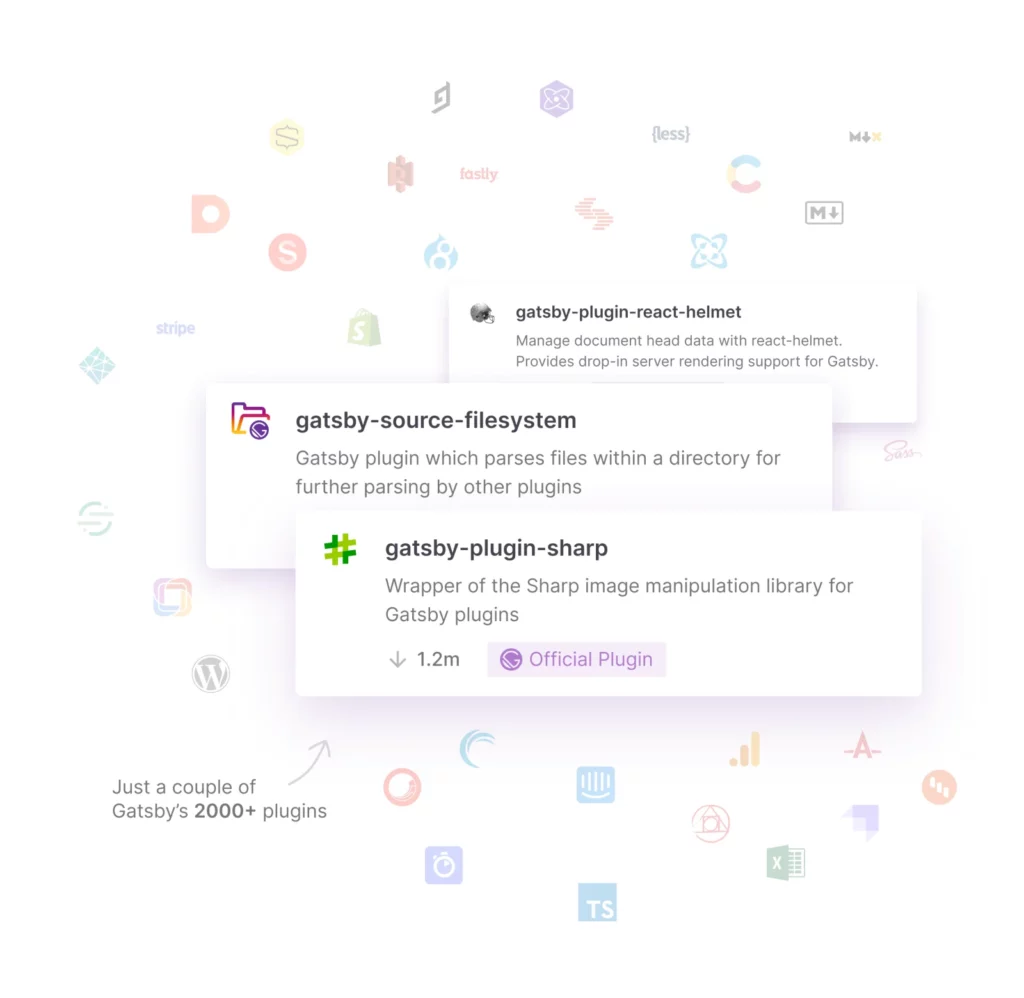

Build fast sites. In record time.

Maybe it's time your CMS had a faster frontend

60%

Faster page loading speed

100x

Faster build times

100x

Faster Content Creation

The numbers are in

100+

of Businesses got online in Australia, United Kingdom and United States of America.

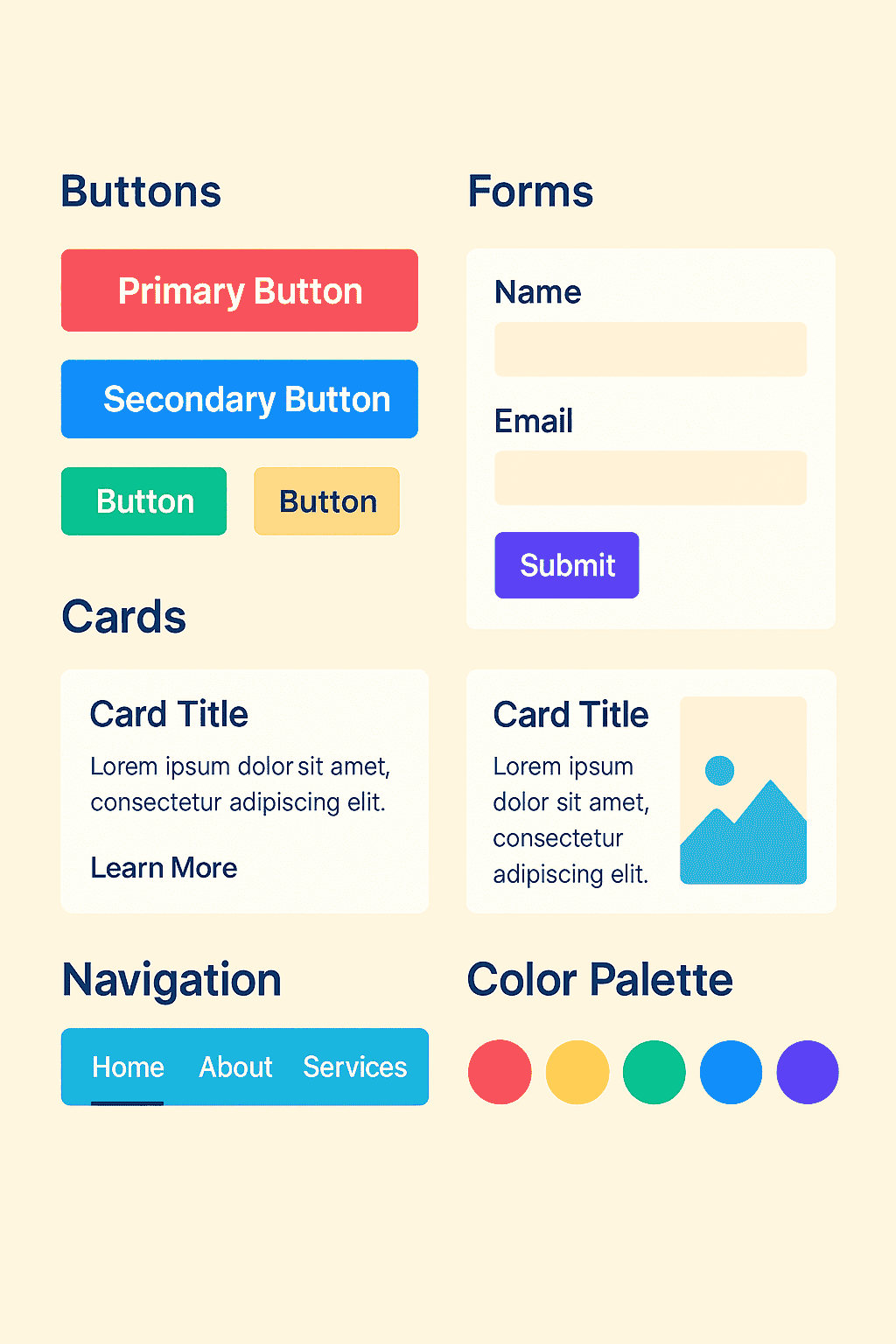

Performance. SEO. Security. Integrations. Accessibility. We’ve got it covered for you. we makes the hardest parts of building an amazing digital experience simple, leaving you more time focusing on your business.

Performance that’s off the charts

we automates code splitting, image optimization, inlining critical styles, lazy-loading, pre fetching resources, and more to ensure your site is fully optimized. No manual tuning required.

our sites don’t require complex scaling operations or expensive hosting. They scale when needed, but when traffic drops so does your usage — and your costs. Host at scale for pennies.

Create your next website in hours – not days or months

Go farther, faster, with WordPress, Vercel, Netlify, Gatsby. Build your next website or web application from the foundation of a Starter template. Easily add functionality, like SEO, analytics, or search, by installing a plugin. Gatsby gives you everything you need to build your next web project – faster.

With Top Frameworks

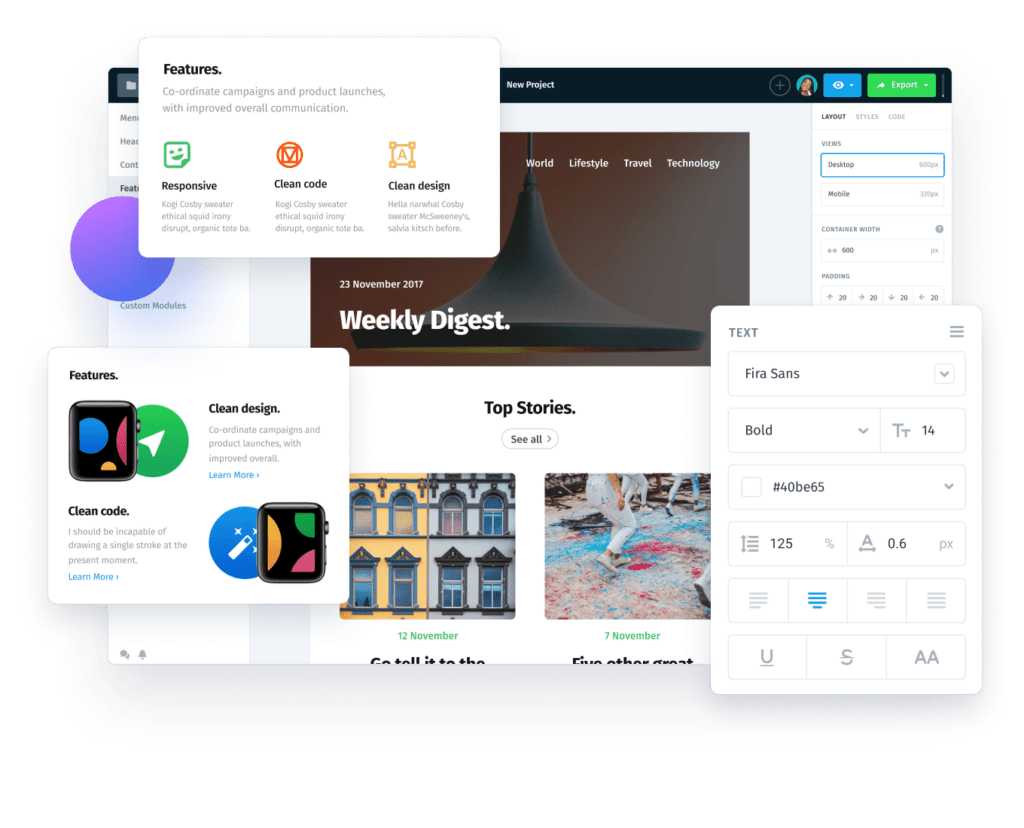

Create incredible websites and email newsletters with simple tools.

Save time & money making websites and emails, so you can focus on running your business.

Why Choose HCJ ART?

Custom Designs: No templates. Your brand, your way.

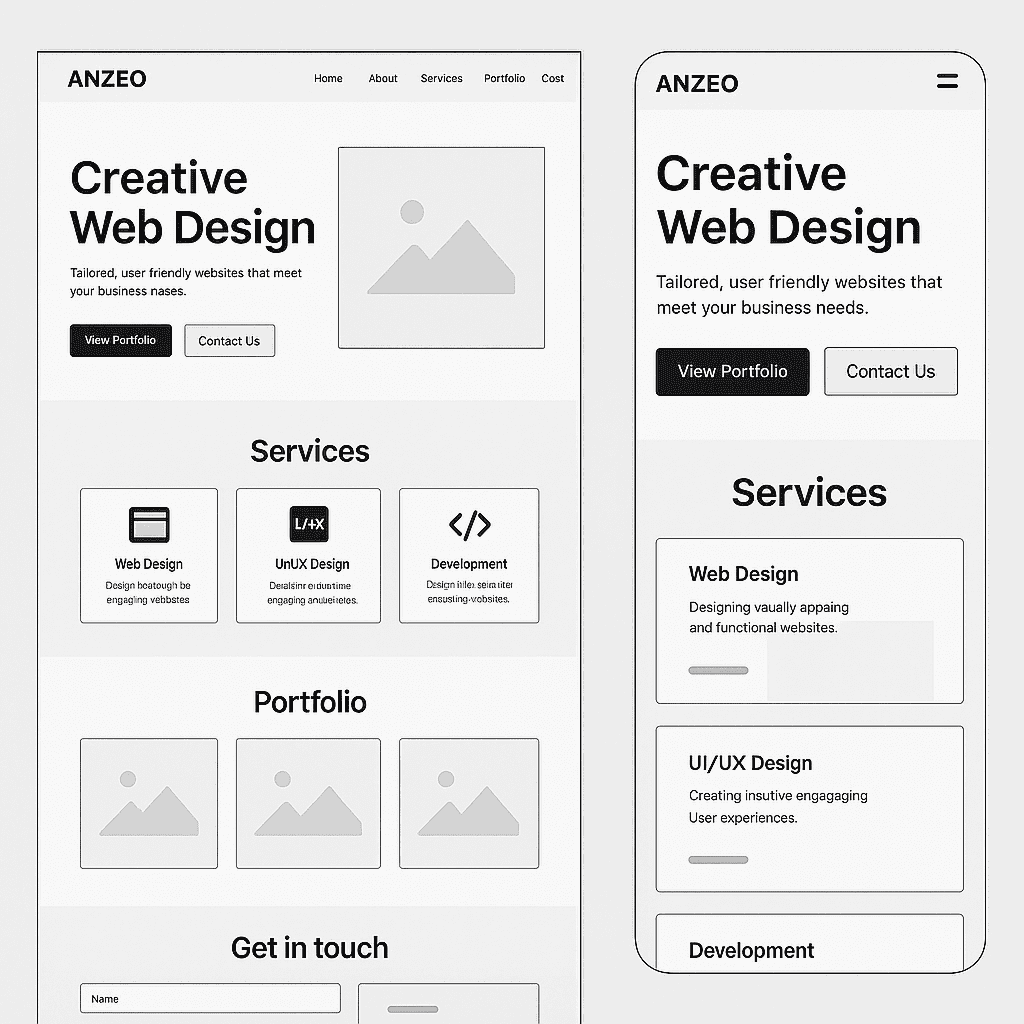

Responsive Layouts: Looks great on mobile, tablet, and desktop.

Affordable Packages: High quality without high costs.

SEO & Speed Focus: Built to rank and perform.

Faster page loads, better Lighthouse scores, and lower bounce rates

The best way to build, deploy & scale .

Free web hosting

we provide free web hosting for students, hobbyist and entrepreneurs. get in touch for more details

limited resources

Premium Web hosting

Choose us for your next business project. we provide custom servers for small to medium scale business starting from $5. (managed)

Digital ocean, vultr, linode.

Starts- 5$

Enterprise Level hosting

Starts- 200$

Business Capital Funding

We understand capital inflow is needed to ensure smooth running of business. Weather you are hobbyist or growing entrepreneur, we provide business financial assistance to everyone with a vision to succeed. get in touch for more details

It costs money to start a business. Funding your business is one of the first — and most important — financial choices most business owners make. How you choose to fund your business could affect how you structure and run your business.

Every business has different needs, and no financial solution is one-size-fits-all. Your personal financial situation and vision for your business will shape the financial future of your business.

Investors can give you funding to start your business in the form of venture capital investments. Venture capital is normally offered in exchange for an ownership share and active role in the company.

Venture capital differs from traditional financing in a number of important ways. Venture capital typically:

- Focuses high-growth companies

- Invests capital in return for equity, rather than debt (it’s not a loan)

- Takes higher risks in exchange for potential higher returns

- Has a longer investment horizon than traditional financing

Almost all venture capitalists will, at a minimum, want a seat on the board of directors. So be prepared to give up some portion of both control and ownership of your company in exchange for funding.

1. Apply

Contact us with all the details and requirements.

2. We review your application

We review your goals and present you with programs matching your needs, getting an offer in 24 hours.

3. Receive funding

Choose the program that fits you best and receive funding within 48 hours.

- Share your business plan

The investor will review your business plan to make sure it meets their investing criteria. Most investment funds concentrate on an industry, geographic area, or stage of business development. - Go through due diligence review

The investors will look at your company’s management team, market, products and services, corporate governance documents, and financial statements. - Work out the terms

If they want to invest, the next step is to agree on a term sheet that describes the terms and conditions for the fund to make an investment. - Investment

Once you agree on a term sheet, you can get the investment! Once a venture fund has invested, it becomes actively involved in the company. Venture funds normally come in “rounds.” As the company meets milestones, further rounds of financing are made available, with adjustments in price as the company executes its plan.

Get a small business loan from us

If you want to retain complete control of your business, but don’t have enough funds to start, consider a small business loan.

To increase your chances of securing a loan, you should have a business plan, expense sheet, and financial projections for the next five years. These tools will give you an idea of how much you’ll need to ask for, and will help the bank know they’re making a smart choice by giving you a loan.

Once you have your materials ready, contact banks and credit unions to request a loan. You’ll want to compare offers to get the best possible terms for your loan.

Contact Us

Some images are copyright of their respected owners. hugo, gatsby, nextjs, are static site generators.